If you are a Middle Manager you will, probably, more than once, be called on to cut costs from your budget.

During the last few years times have been turbulent and cost cutting has become more prolific.

Being asked to cut costs is always difficult and stressful. There is the spectre of laying off people or not filling needed roles, of cancelling projects and programs, of asking your team to take on more work, work faster.

A Different View

I offer a different view on cost cutting by suggesting that you view the exercise through the eyes of productivity. The highest productivity measure of a company is the relationship between the resources used and the revenue produced. This is return on investments (ROI) and is measured as a percentage.

I have experienced first hand the use of this productivity view in a company in which I was an executive in South Africa. Over a period of 5 years, by focusing on productivity, we moved the needle on ROI from 13% to 45%.

Productivity is the ratio between resources used and results obtained.

We developed a measure that was used by every manager and supervisor in the company and many individual contributors. Interestingly the business we were in – providing mining underground support systems – was a mature industry. With only 7 customers (the main mining houses) and no major growth in the need for timber supports the company was considered a cash cow to fund growth in other areas of the holding company.

The productivity view started when a new Managing Director was appointed. Soon after he joined the company we presented to him the budget for the following year. He saw we had calculated a ROI of 11%. He said that was not satisfactory and sent us back to work on the numbers. We came back a week later after trimming expenses to offer a ROI of 13%.

He accepted the 13% as what he would present to the Board the following week, but, in doing so he said, “While I am presenting this to the board, I want you to know that we will be targeting to get 25%!”

And then he said the magic words “I do not know how to do that, so we will have to learn how to improve productivity in every part of the organization, targeting both the cost side and the revenue side of our business.”

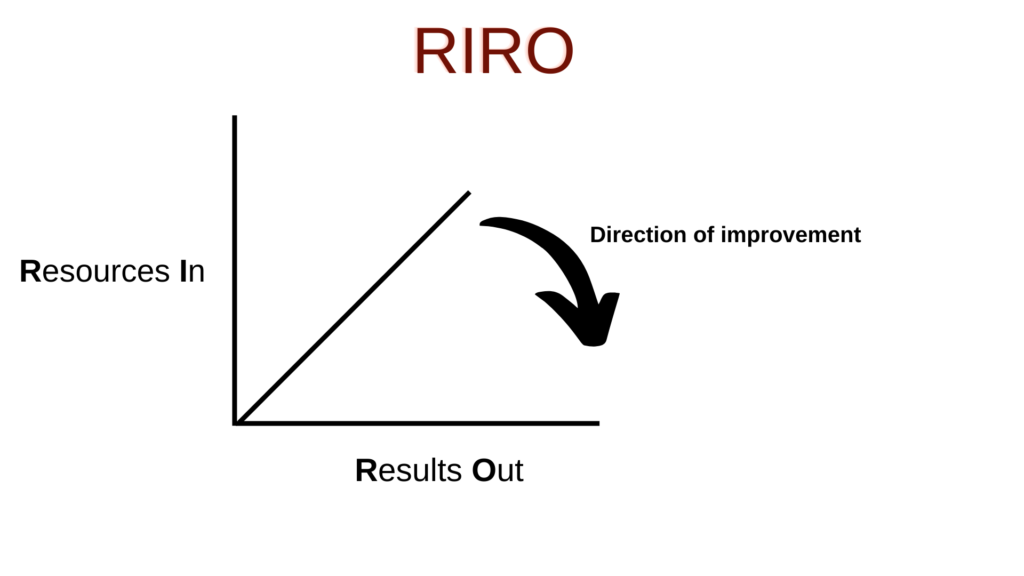

And with the help of a consultant, the late Rodney Blanckenberg we set about learning. The learning is encapsulated in a very simple graph – the RIRO.

The key to our success was this simple graph. Everyone in the company down to lowest supervisory level had a RIRO. Every time we visited a manager’s office the first thing we would look at was the RIROs on his/her wall. It captures the ratio between resources used and results obtained.

How the RIRO works

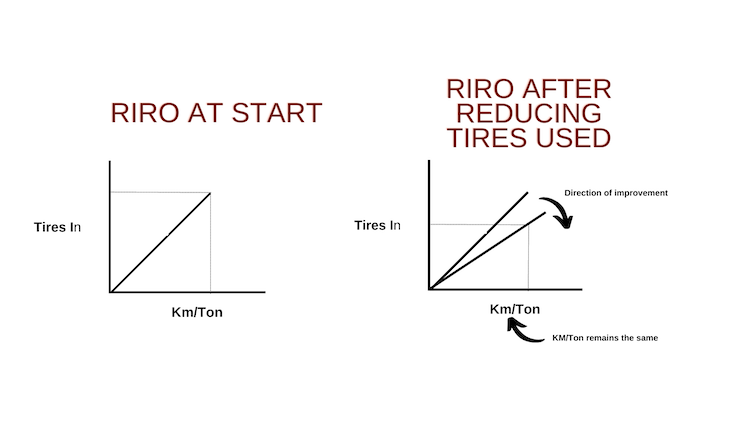

A manager will look at the resources under their control that are being used to get the results for which they are accountable. A MM might have more than one RIRO. For example, FTE, Gas, Tires, repairs. I will use the example of a distribution manager RIRO for tires. The MM will calculate the usage of tires per month and that will be the resources in on the left axis. The RI.

With these two known measures the MM creates the RIRO with the initial measures forming a 45 deg angle as shown in the sketch. To improve productivity the direction of improvement must move as shown in the diagram.

Productivity , in this case, can be achieved in one of three ways:

– Use less tires for same ton/kms

– Use same # tires for increased tons/kms

– A combination of tires reduced and tons/km increased

Productivity improvement at this level will work its way up to an increase in ROI.

Do RIRO’s work everywhere?

Yes. I offer three examples:

RIRO with FTE on left arm and #bills paid on the right arm. This RIRO led the manager to drastically reduce the number of vendors and consolidate many of the remaining. This led to a reduction in FTE and a lowering of cost of goods and services due to larger volume negotiations with suppliers.

RIRO with # saw blades used on the left hand arm and meters/std diameter timber cut. This took a bit of data collection as the results out had never been measured in this way. The saw doctor started experimenting and finally was able to make a few changes that resulted in a more expensive saw blade and a new sharpening method, which these blades allowed, being implemented. Important to note that the increased cost per blade was far outweighed by the amount of timber the blade could cut and the number of times the blade could be sharpened and reused. In addition the number of times the saw was inactive due to blade changing also decreased. BTW he also has a RIRO covering # blunt blades in and number of useable blades out

RIRO in sales: Number tons timber sold on left arm and Earnings per Ton on the results arm. This led to a focus on value added marketing which ultimately resulted in doubling the earnings per ton. We bundled the timber as needed by each mine shaft, to enable the mines to handle the timber faster and more easily, we fireproofed the timber (it was the only thing that burned underground), we did a lot of R and D on mine supports eventually reducing the amount of timber needed and an improvement in the rate that the ‘hanging wall’ would close without rock explosions.

It was necessary to look at added value in sales as the market was mature and not growing.

RIROs and Innovation

RIROs force a company and managers into first principle, constraint, process thinking and innovation.

Simple example. In the South African company meals were provided for the distribution yard workers. As the manager was looking to constantly improve things he noticed that the diners would leave all sorts of garbage, empty cartons, cups etc on the window sills of the eating hall. He had tried cajoling, encouraging and threatening offenders to no avail. Finally he had the window sills modified to slope at 45 deg’s – problem solved. And one more way in which he could contribute to feeding all who needed feeding without adding more staff.

RIROs and Cost cutting

If on an ongoing basis a whole company is looking at productivity improvements at every level the need for across the board cost cutting will be unnecessary, except in extreme cases such as market collapse, Covid or a competitive disruption.